Learn the 5 C's of Credit

It can be difficult to get credit if you don't already have a credit history

Signing up for a Secured Credit Card

Learn how to cosign your parent to get a credit card

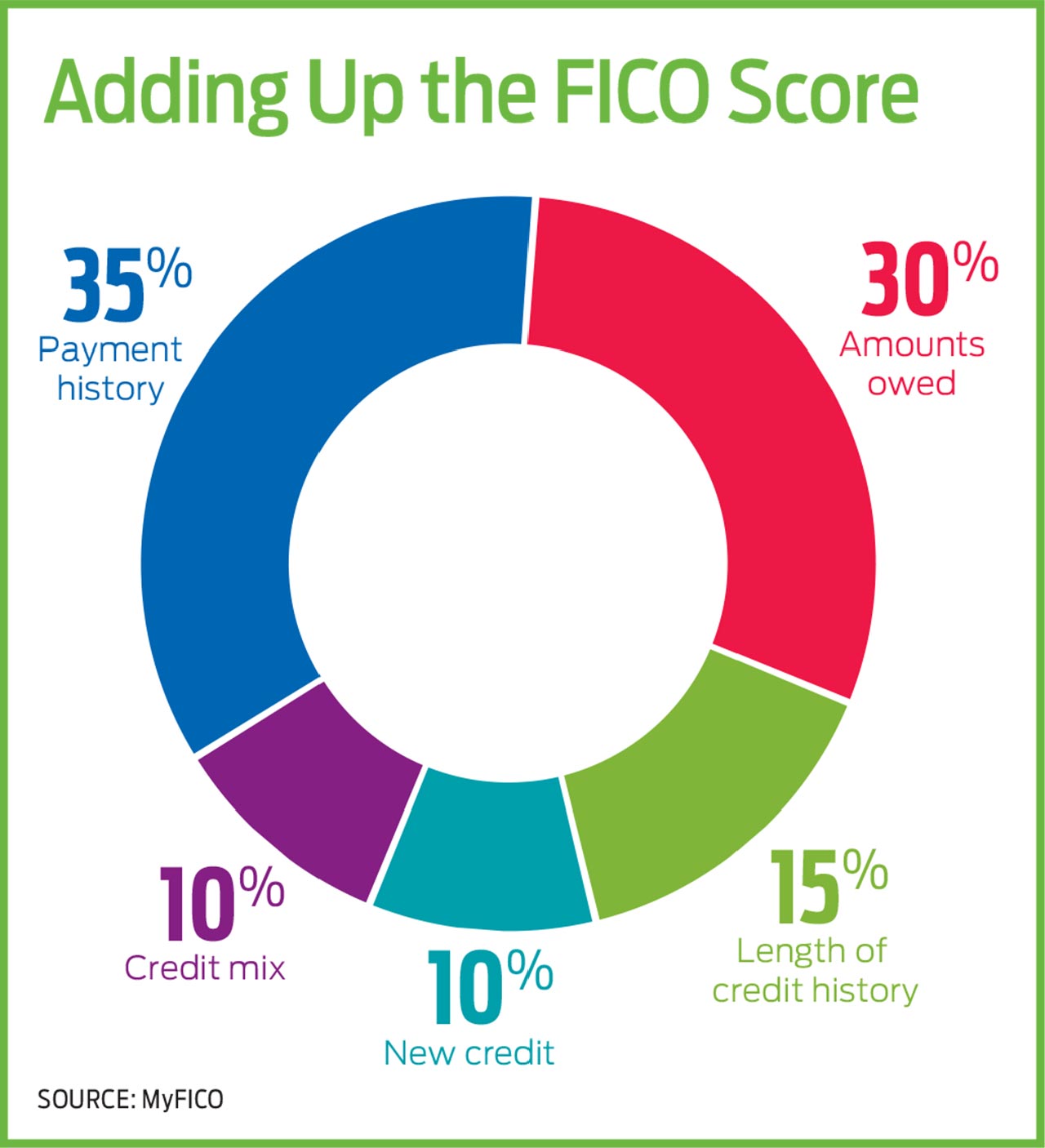

Learn the different categories that make up a credit score

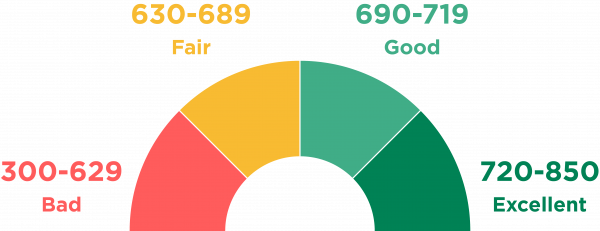

Understand credit score ranges

Learn credit habits to maintain or improve your credit score

Make a list of items that realte to your finances such as:

To develop clear financial goals, think about your attitude toward money and ask yourself some questions:

It is impossible to make a good decision unless you know all your options. If you save $50 a month, here are some options you have:

You must consider the consequences and risks of each decision you make

You must consider the consequences and risks of each decision you make

Most apartment complex do a credit score check

Electric companies contend that you’re borrowing one month of electric service

Before turning on your electricity, the company will check to see if you have good credit

Most utility services conduct credit checks, including cable, telephone, water, even cell phone service providers.

Goals can be defined by the time it takes to achieve them:

Your credit affects your interest rate

Interest rates directly impact your monthly mortgage payment, by either increasing or decreasing the amount you are charged

Low credit scores will cause a loan application to be disapproved, or approved at a higher rate.

Many employers conduct credit checks as part of the hiring process. (Note that employers check credit reports, not credit scores.

A credit score is a number between 300–850 that depicts a consumer's creditworthiness. The higher the score, the better a borrower looks to potential lenders

A credit score is a number between 300–850 that depicts a consumer's creditworthiness. The higher the score, the better a borrower looks to potential lenders

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

1:38

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

Understand to how to effectively save money for short and long term financial goals.

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

You'll learn how to allocating resources, usually money, with the expectation of generating an income or profit

Learning to create many static and dynamic web pages online and presented them on demo day competitions.

Learned about truth table, booleans and many other data types using Python.

Self-learning ReactJS through online courses and currently working a financial literacy app with ReactJS.

Learning about different data types and utilizing Java in many applications and self-studying for the AP Computer Science A exam.